Institutional investment accounting and reporting platform that helps customers reduce the cost and complexity of managing global investment portfolios.

-

00. Summary

-

01. Industry Overview

-

02. WealthCanyon

-

03. Challenges

-

04. The Project

-

05. Solution

-

06. Benefits

-

07. DigitalRoute

00. Use Case Summary

01. Industry Overview

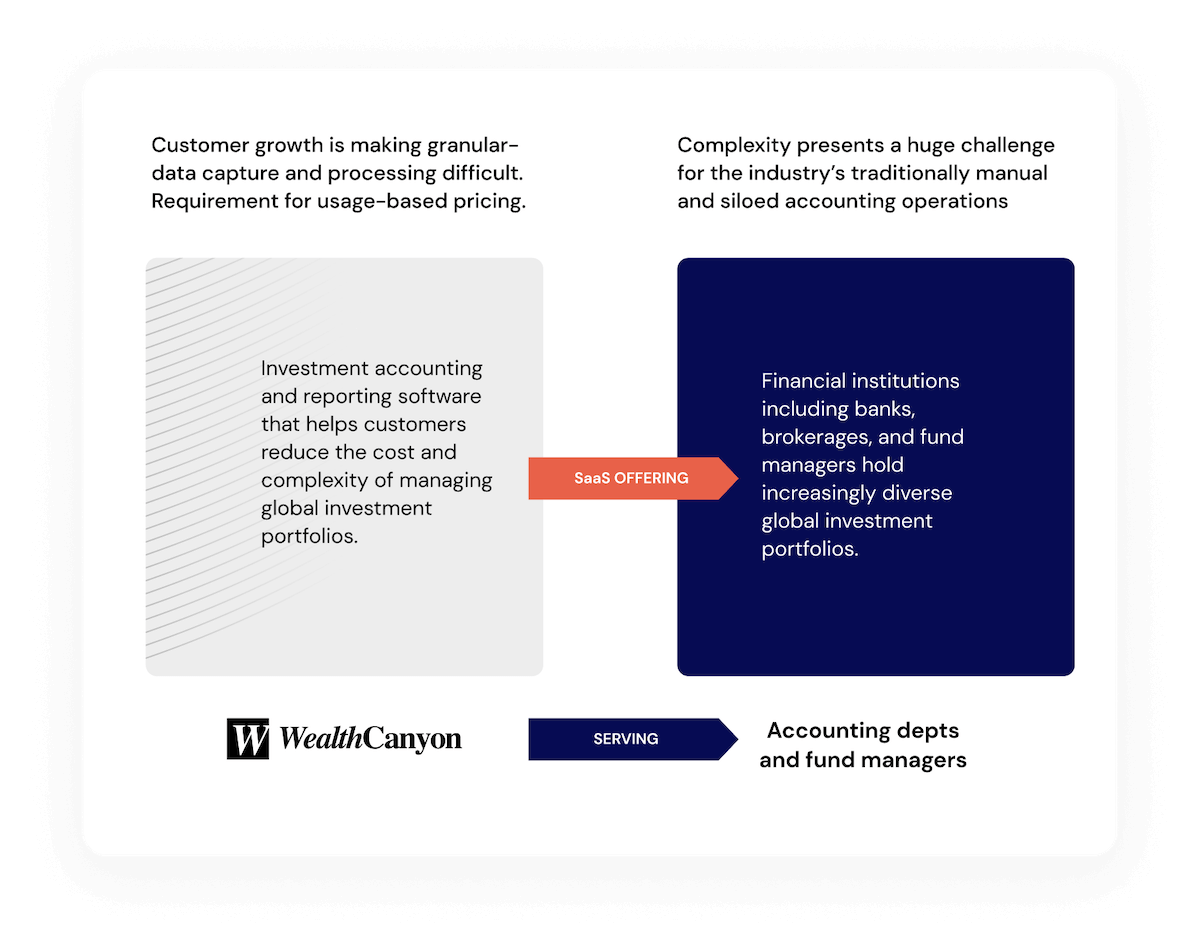

Financial institutions including banks, brokerages, and fund managers hold increasingly diverse global investment portfolios. This complexity presents a huge challenge for the industry’s traditionally manual and siloed accounting operations.

Accounting departments and global portfolio managers rely on investment accounting and reporting platforms that can process the information from thousands of daily investment values and transactions, and provide precise financial reporting and analysis. These platforms need to efficiently and rapidly gather accurate data from across multiple entities, asset types, currencies, and geographies neatly packaged together in an intuitive and easy-to-use software.

By building secure connections to financial institutions, custodial sources and third-party financial data providers around the world, these software-as-a-service (SaaS) platforms are able to provide portfolio data aggregation as a service, which delivers solid accounting information and precise reporting for portfolio owners and managers.

However, in many cases the complexity and scale of the distributed data means that investment accounting and reporting platform providers, such as WealthCanyon, have to deal with fragmented data and difficulty when billing for a customer’s entire portfolio.

Typically, companies like WealthCanyon rely on manual processes and desktop applications to track and provide records for billing, but inefficient data processing consequently translates into revenue leakage and increased costs. To stay competitive, these companies need to overcome manual process and introduce automation into the management of their data.

02. WealthCanyon

With access to data from thousands of financial institutions, as well as third-party data vendors, WealthCanyon reports on $5 trillion in assets daily. Each day, via secure and encrypted API connections, WealthCanyon delivers updated data related to each asset in their client’s portfolios.

The centralized portfolio data provided by WealthCanyon, supports efficient reconciliation, accounting, and reporting for their customers’ financial operations, while fortifying risk mitigation and compliance processes. Accurate and timely data also helps WealthCanyon’s customers deliver a superior investor experience.

03. Challenges

WealthCanyon delivers hugely valuable information and insights to their clients every day. To do that they need to process a massive amount of data, however, translating that data into a monthly billable format was at the core of their challenges.

Despite supporting efficiency and automation for their clients, WealthCanyon were highly reliant on their own manual processes. As a result, they were taking on unnecessary costs and risks, which included their own revenue leakage caused by human error and inaccurate or missing data for billing.

To begin with, it took several days to add new customers to the billing system. For each new contract, the billing team had to analyse the service agreement to decide if new integrations, software development or manual processes were required to serve that new customer.

This resulted in a slow, and ultimately compromised, customer onboarding experience. It also put pressure on the team to get everything ready in time for the next billing run. Though their results were generally good, they were not perfect — and they were far from efficient.

Additionally, inefficient manual billing processes and the inability to fully capture and process granular data from the widely distributed investment transaction systems of their customers, was preventing them from introducing usage-based pricing tiers and negatively impacting their growth.

04. The Project

One of WealthCanyon’s biggest clients is Imerica Bank, which has 25 subsidiaries around the world. Each subsidiary has their own investment portfolio consisting of hundreds of individual stocks, bonds, securities, and other financial assets.

The portfolios of Imerica Bank’s 25 subsidiaries are held by 25 different regional clearing houses. On a daily basis, WealthCanyon pulls data from those clearing houses via an API call and delivers it to Imerica Bank, all in one centralized platform.

However, not all data points deliver the same value for Imerica Bank. The bank is willing to pay a higher price for data being analyzed and reported on, for securities funds held in the US, which have complex reporting requirements. They want a lower price for less complex assets held outside the US, such as government bonds.

In order to offer that dynamic billing, WealthCanyon needed a way to set a variable price based on each individual asset’s unique attributes, and then to summarize the captured data on a customer specific basis so that each customer’s specific billing terms and conditions could be calculated correctly by the billing system.

Also, a big issue to address was with WealthCanyon’s enterprise application stack. They have a modern CRM and ERP, but relied on a legacy billing system, and homegrown integrations to customer systems and data sources. The company needed the integration between their enterprise applications and the WealthCanyon proprietary investment and accounting platform, to consume customer data using a common format. The non-standard formats being used between the systems was causing a serious bottleneck and unwanted delays.

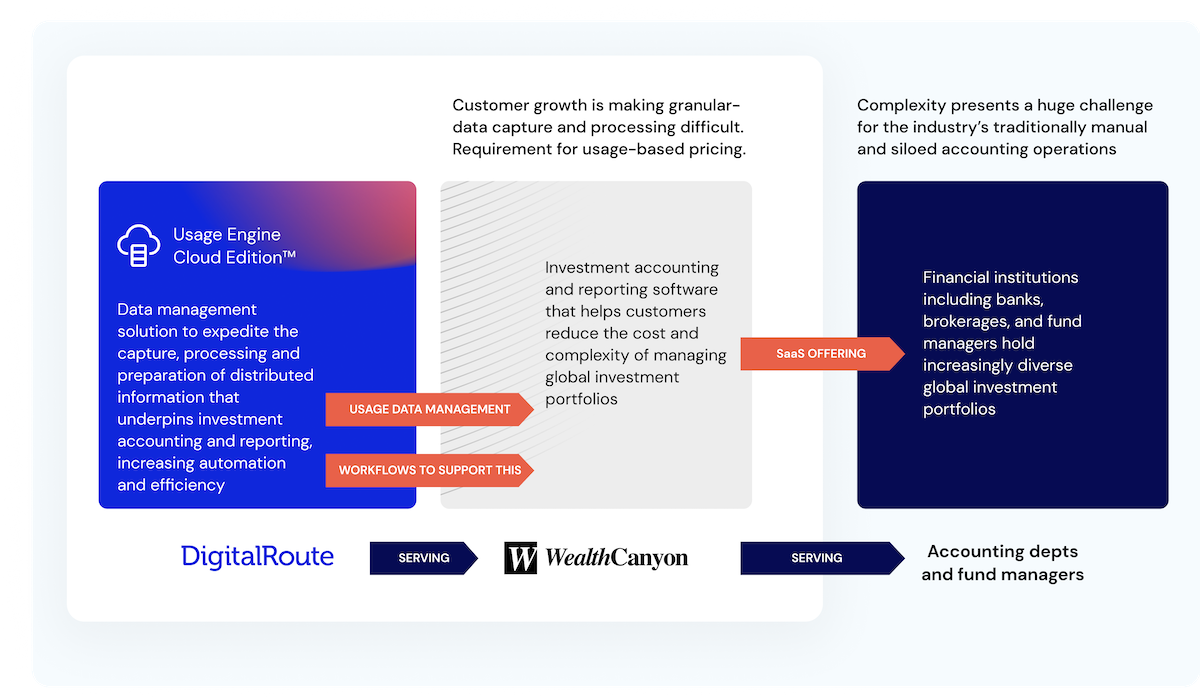

DigitalRoute needed to help them automate the collection, accuracy and processing of usage data from the investment transaction systems, to make sure they can honor their claims and better serve their clients.

05. Solution

To address the data challenges of WealthCanyon, DigitalRoute implemented their Usage Engine software, complete with pre-defined and uniquely designed workflows to meet their needs.

By deploying pre-built frontend integrations with secure APIs, DigitalRoute was able to collect transaction system usage data from WealthCanyon’s distributed customer network of clearing houses, exchanges and settlement systems.

Addressing the need to standardize the data format used by the WealthCanyon enterprise applications, the DigitalRoute solution will perform normalization of the incoming data, including use of the data-source-specific enrichments required for the process. Usage Engine matches the same attributes from different sources into common terms.

After quality checking the customer’s data for missing or erroneous records, it is then grouped (or aggregated) into logical, often customer specific, sets before being enriched with relevant and associated information from the ERP and CRM systems.

Finally, the data is converted to and distributed as precise and detailed records to the WealthCanyon Investment Accounting and Reporting platform, to their ERP and billing systems.

WealthCanyon can now integrate all software and data formats, with any type of communication protocol, be it batch or real time, regardless of whether that’s transaction system usage data or data from the CRM and ERP. With DigitalRoute’s native tools for revenue leakage prevention, WealthCanyon can better ensure data integrity, capturing every spot of data to make sure the billing is as accurate as possible.

06. Benefits

Setting up new customers and monthly billing is now streamlined, freeing up staff to work on more strategic, revenue-generating tasks. Their billing is now more accurate with less miscalculated invoices to fix. This not only saves time but helps to identify and prevent revenue leakage.

With a more flexible back-end business system, the sales team can quickly offer flexible pricing models that can be easily adjusted for each customer. They can even offer multiple pricing schemes for different entities within one customer. In addition to gaining a more competitive pricing model, once client contracts are finalized, the variables of the agreements are now easy to plug into a billing profile.

Going forward, the new solution makes it easy for WealthCanyon to react to their customers’ requirements, which gives them the confidence and ability to grow the business.

07. DigitalRoute at WealthCanyon

The DigitalRoute Usage portfolio was purpose-built to solve the data challenges of subscription and consumption-based models. It’s a scalable solution that handles revenue-critical transactions for any volume of data, from any source and in any format. In this case, WealthCanyon uses DigitalRoute Usage Engine to overcome their billing challenges

Take the next step with DigitalRoute

At DigitalRoute, we process data about how our customers use digital services. Our software is everywhere: it’s used by telcos, streaming services, SaaS firms, and in innovative business models for transportation and mobility- as-a-service. We help more than 400 companies send accurate invoices, improve customer experiences, and control how much of a service is used. Our software even helps companies create entirely new services based on what customers want.

If you’re ready to explore how we can help you, let’s talk.