Introduction

The onset of each new generation of cellular network technology, like the transition from 3G to 4G, has traditionally been accompanied with excitement primarily surrounding enhancements in speed and bandwidth capabilities, however, it lacked true monetization opportunities and enhanced capabilities offered to the end clients. The transition to 5G is more provocative than simply its transfer speeds (as impressive as they are), because along with it came an array of revolutionary improvements and use cases.

The rollout of the two deployment modes of 5G that CSPs can opt for when transitioning from 4G – Non-standalone (NSA) and Standalone (SA) – offer 5G adoption flexibility depending on their maturity level, business goals, and number of legacy subscribers, with the direct transition to a 5G SA architecture and the deployment of NWDAF (Network Data Analytics Function) being the most transformative as consumers and industries alike are increasingly demanding premium services from their CSPs.

Initially conceived as a tool for monitoring and optimizing network operational performance, NWDAF has rapidly evolved to encompass a diverse array of applications and use cases beyond 3GPP-defined ones. And as a response to market demands, CSPs are coming up with new ways to offer, monetize, and charge for their 5G services, and develop new ones as they capitalize on the capabilities and insights that 5G NWDAF brings to the table.

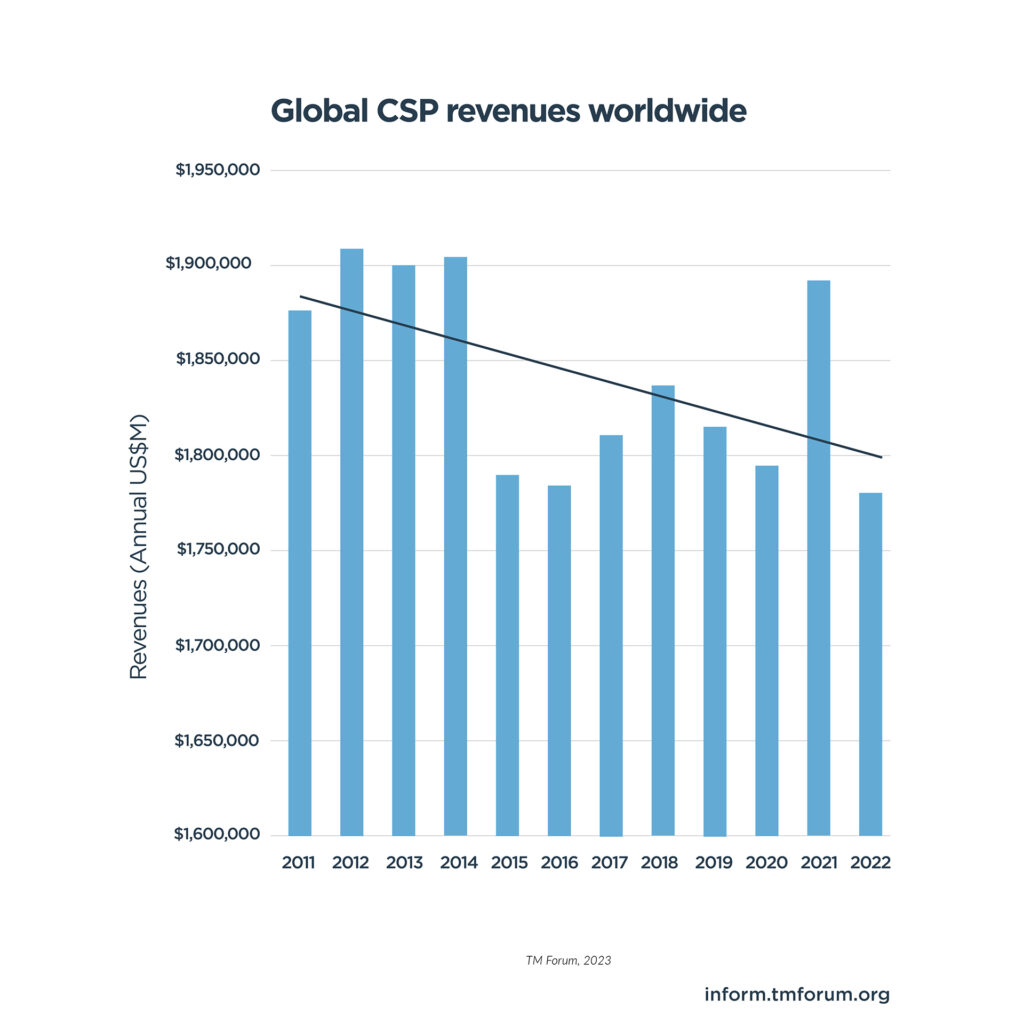

However, the key question still remains: Will CSPs miss (again) the opportunity to monetize the new capabilities that 5G brings, especially in the B2B market, and get back on the growth path?

Judging on how their CXOs believe, shown on this TM Forum 2022 CEO report below, they won’t miss it this time around, but there are different thoughts on how much this revenue growth will be. Can different expectations on the monetization of new capabilities such as network slicing and private networks potentially be the reason?

Realizing the Potential of 5G: A New Frontier for Premium Services

CSPs that are looking to provide mainly “next gen 4G” functionalities that are still dependent on 4G architecture to customers with 5G-ready devices will probably opt to invest in 5G NSA as it would allow them to continue leveraging their existing 4G network assets. Those that are looking to offer a more profound set of premium services, however, will most likely either transition directly towards 5G SA or move towards it as they mature.

The allure of 5G SA is logical as CSPs have a lot to gain when given the ability to provide a flexible, scalable, and efficient infrastructure for delivering 5G network services with the following new set of benefits:

Network Slicing Functions

Allows operators to create isolated, end-to-end network segments tailored to specific customer needs or applications. This is particularly important for delivering differentiated services in multi-tenant environments and private 5G networks.

Ultra-Low Latency

Critical for applications in industries such as HD/AR/VR/XR gaming, automotive, healthcare, and industrial automation.

Scalable

Cloud-native 5G Core allows operators to scale network resources up or down dynamically based on demand.

Agile

Cloud-native architecture enables rapid service deployment and updates. Operators can quickly roll out new services, features, and network slices to meet changing customer and market demands.

Cost Efficient

By virtualizing network functions and leveraging cloud infrastructure, operators can reduce capital and operational expenses. This is achieved through efficient resource utilization, network automation, and the ability to share resources across multiple services.

Business Model and Service Innovation

The transformative benefits of the industry-agnostic capabilities of 5G SA include a wide range of applications. CSPs can offer new services based on the capabilities of the 5G SA and they can introduce new business models for the monetization of these new services, like charging an industry automation service based on analytics metrics or based on how many times an API has been invoked.

5G Standalone is quite a radical breakthrough in mobile network technologies compared to previous generations that referring to it as simply the subsequent version of 4G almost sounds inaccurate.

Considering the benefits mentioned above, CSPs that have invested in 5G network infrastructure are diversifying their service offerings to cater to various new customer segments and industries that they haven’t served before. They are also strategically partnering with manufacturers, technology vendors, vertical industries, cloud service providers, and others to drive innovation. For instance, offering Network-as-a-Service could secure a CSP’s place in delivering value to customers, especially towards B2B customers, in order to keep their “Industry 4.0 key enabler” role.

Challenges on the Path to Premium Service Monetization

The pricing models for mobile network services have evolved over time as technologies, customer preferences, and consumption patterns change. Over the years, we have come across payment plans such as contract, prepaid, family, bundles, pay-as-you-go, tiered data, shared, unlimited data, add-ons – basically telecom pricing models based on minutes, SMS/MMS sends, and data consumption.

Conventional telecom pricing models fail to highlight or leverage unique service attributes that could enable differentiations in services and pricing. They are optimized for standardized, one-size-fits-all strategies that no longer resonate with the unique ways customers want to consume and pay for products and services, therefore inhibiting tailored, personalized service experiences and customer satisfaction. The result is clearly seen on the graph below, which shows the CSP Global revenue decline over the last 10 years, as provided by the TM Forum CEO Report from 2022.

From a technical standpoint, telecoms that are still running on legacy Business Support Systems (BSS) and Operations Support Systems (OSS) might lack the agility to support more dynamic pricing strategies. Such general-purpose systems were designed with the more straightforward ways of consumption and preferences in mind. They simply aren’t able to support the level of granularity and complexity that modern consumption-based services require, especially when it involves real-time processing.

Not being able to handle modern transactional tasks is one thing, but when their legacy support systems are also not able to provide any analytical and operational intelligence back, it is yet another blindfold for CSPs. If they don’t have any insights as to how their services are performing, how individual features are being used, how their customers are experiencing their offerings, the real-time network conditions, etc., it’s a challenge to identify business values, therefore dampening their ability to provide value to customers and monetize them.

Unleashing Differentiation: NWDAF as a Monetization Enabler

Consumers, whether it’s individuals or industrial enterprises, have a unique valuation of products and services these days. For a person who lives in a remote area, it is remote and secure access to healthcare services via a telemedicine platform. For urban developers working on a Mobility-as-a-Service (MaaS) platform, it could increase the ridership in public transportation systems. For companies in the Industry 4.0 space running smart factories, it could be efficiency in the production and intralogistics processes.

Consumers are willing to pay more, and differently, for what brings value to their lives or businesses. Monetizing services based on values and outcomes was simply unthinkable when you’re counting minutes and bytes and sending a monthly invoice to customers.

When NWDAF was introduced to provide standardized data analytics functionalities into 5G Core networks, it enabled CSPs to explore uncharted territories like some of the ones mentioned above and develop new revenue streams based on the insights that their network data is serving them.

Thanks to NWDAF’s analytics engine, closed-loop automation, and real-time data capabilities, CSPs are presented with deep insights on network performance, quality, and user behavior and preferences, therefore allowing them to make business decisions faster and optimize their offerings, including their pricing models, with confidence.

NWDAF isn’t just another fancy new capability; it empowers CSPs to get creative with their pricing models, but only if you don’t buy and deploy it as “another network black box”. Just like in the earlier days of telco, some CSPs today have retained some of the conventional pricing strategies such as bundling or offering add-ons to certain market segments. Markets that require more sophisticated pricing options, however, are now enjoying the benefits of pricing models such as outcome-based pricing and quality of service pricing.

Unlocking New Horizons: NWDAF’s Expanded Role

NWDAF’s expanded capabilities, such as aggregating data from multiple network domains, notably encompassing the radio and transport layers, extend far beyond the conventional realms of data collection and processing.

By definition, NWDAF is a domain-specific component covering only the Core Network layer and thus providing analytics only for the specific segment of the network. As an example, in the Network Slice Load Analytics, NWDAF provides insights only for the load of the Core Network Slice ignoring the status of the Radio and the Transport layers. With SAS/DigitalRoute disaggregated solution, statistics can be collected from all three layers of the network and provide an end-to-end analysis on the Network Slice load, not limited to the Core Network only.

This empowers CSPs with a more comprehensive perspective on opportunities for monetization and charging. It puts them in the driver’s seat and allows them to add use cases that are related to and extended by NWDAF, which will serve as their competitive advantage.

CSPs can use the information that NWDAF serves in putting together new charging strategies. Some of the metrics or information elements that they can develop their strategies around can include the following, just to name a few:

- Latency

- Throughout

- Maximum packet loss rate

- Service experience statistics

- Number of PDU sessions

- Number of registered subscribers

- Load level

By offering CSPs a panoramic view of their network’s resource allocation, behavior, and consumption patterns, NWDAF provides strategic assets that can be harnessed for monetization purposes. It transcends the limitations of traditional data processing, enabling CSPs to unlock the full spectrum of opportunities presented by their network infrastructure.

The Path Forward: Monetizing the Future with NWDAF

Could NWDAF be the key to unlocking 5G network data monetization’s full potential or is it simply a recipient of 5G data information?

Considering the innate capabilities of 5G and the giant strides it has made so far in comparison to previous generations, and considering the fact that it’s still evolving, NWDAF is becoming more and more of a critical component to the 5G network. For CSPs, NWDAF could even become synonymous with 5G, especially if you extend it with other data sources from RAN and Transport network to get an end-to-end service view.

Certain NWDAF solutions on the market today, which are open and disaggregated, will help the CSPs to revolutionizie charging practices and align seamlessly with consumer and business demands for premium services to a much bigger extent. A disaggregated NWDAF will give the CSP a much more flexible solution to adapt faster to new demands, decrease the Total Cost of Ownership (TCO) by leveraging the already-made investments, support new use cases beyond the standard 3GPP use cases and enable business model innovation.

In essence, NWDAF’s analytical prowess, combined with 5G’s speed and capabilities, creates a synergy that will not only enable CSPs to meet the current demands for premium services but also anticipate and adapt to the evolving needs of both individual consumers and diverse industry sectors. This forward-looking approach is unique to the market and it positions CSPs to be at the forefront of delivering value, fostering innovation, and shaping the digital landscape of the future.